How We’re Different

The EB-5 Visa program was created in 1990 to spur job growth in distressed communities of the U.S. Congress wished to extend to foreign nationals the privilege of living and working permanently in the U.S. if they invested in communities that needed jobs. This is still the purpose of the Program and our purpose too.

We believe private developers who raise capital for their own projects run the risk of looking out for themselves rather than their investors. We are not private developers. Bluegrass International Fund selects EB-5 investments free of conflicts and with a steadfast focus on protecting our investors’ capital.

With so many choices in regional centers, we believe EB-5 investors should consider the four P’s of investing when choosing a regional center. Here are ours:

People

Bluegrass International Fund’s team is comprised of successful business and community leaders whose reputations have been built on integrity and trust. Our multidisciplinary experience allows us to analyze EB-5 projects from every angle so we can provide the highest quality investments that carry the lowest amount of risk.

People

Bluegrass International Fund’s team is comprised of successful business and community leaders whose reputations have been built on integrity and trust. Our multidisciplinary experience allows us to analyze EB-5 projects from every angle so we can provide the highest quality investments that carry the lowest amount of risk.

Philosophy

Bluegrass International Fund’s investment philosophy is guided by four principles:

- Invest for capital preservation

- Invest in Targeted Employment Areas

- Invest conflict-free

- Invest to enhance our investors’ future and the future of communities we serve

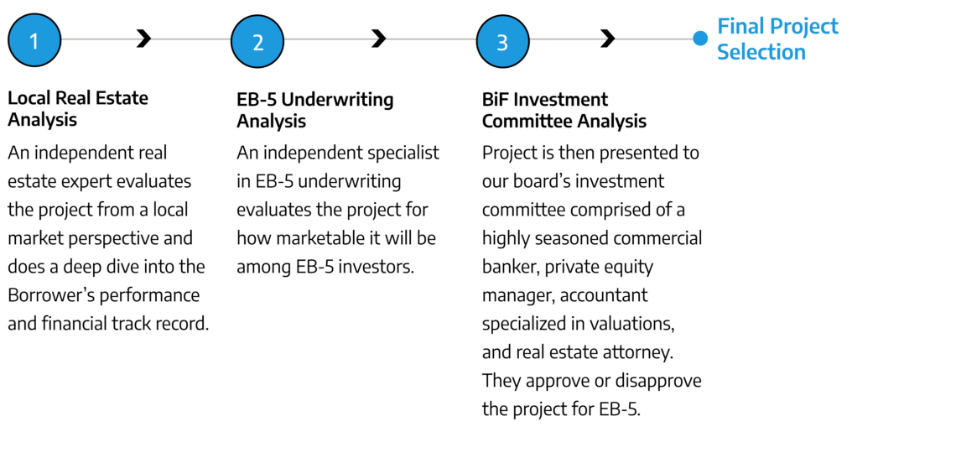

Process

Bluegrass International Fund employs a consistent, disciplined, and conflict-free process designed to help ensure our EB-5 investments are well-secured and can withstand scrutiny from every perspective. This three-step due diligence process reflects our unwavering focus on capital preservation.

Process

Bluegrass International Fund employs a consistent, disciplined, and conflict-free process designed to help ensure our EB-5 investments are well-secured and can withstand scrutiny from every perspective. This three-step due diligence process reflects our unwavering focus on capital preservation.

Performance

To reduce each project’s risk, we require that each project meet the following investment criteria:

- Each project must be fully funded through a bridge loan to allow the project to complete construction independent of our investors capital.

- Each of our borrowers must commit at least 20% of their own equity to a project.

- Our EB-5 investors commitment to the financing is capped at 25%.

- Each project must qualify as a Targeted Employment Area project and be expected to qualify after any proposed changes in EB-5 regulations.

- Each project must have some form of public support or incentive, be it city, county, state or federal.

- Each project must be appropriately “sized” to the EB-5 market that considers EB-5 quotas and other market dynamics.